Investments in learning often fall short – not because people don’t learn, but because the behaviours required for impact are never clearly defined, reinforced, or measured. Peopleway® LINK changes that.

Built on 40 years of learning science and impact-architecture development, LINK connects learning to behaviour by identifying the knowledge, emotional drivers, and actions required for real performance – and capturing the behavioural data organisations need but currently lack.

By embedding these behavioural requirements into programs from day one, LINK turns learning into a measurable driver of business performance and provides a scalable data foundation for predictive analytics and continuous improvement.

Leaders shape culture, performance, and the organisation’s ability to adapt – yet most leadership development fails because behaviour is neither visible nor measurable at scale.

Peopleway® 360 solves this by providing high-resolution insight into leadership behaviour across all levels, enabling targeted development, clear accountability, and measurable growth.

Co-developed with the Leadership Pipeline Institute (LPI), Peopleway® 360 links feedback directly to action through behaviour-based assessments, stakeholder dashboards, and AI-supported reinforcement.

The result is a leadership development process that is scalable, data-driven, and consistently translated into stronger day-to-day performance.

Most fraud models fail not because the technology is weak, but because they lack the specialist human behavioural data needed to make accurate decisions.

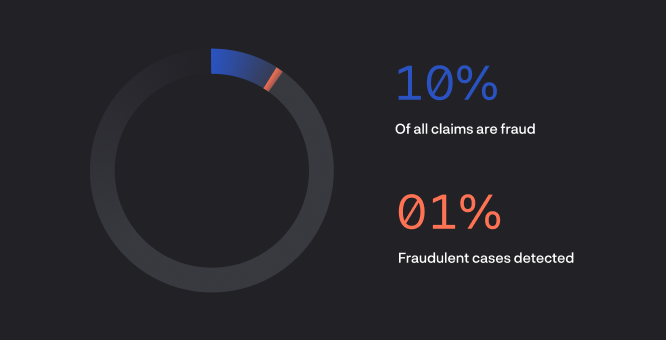

Claims teams often miss low-frequency, high-value fraud indicators – which is why around 10% of all claims contain fraud, yet only 1% are detected – simply because traditional systems cannot capture or interpret human behavioural cues.

Peopleway® Fraud provides this missing layer of intelligence – guiding adjusters in real time, reducing cognitive load, and supplying AI systems with the behavioural signals they cannot generate on their own.

The result is a more complete fraud-detection strategy, higher-quality leads, and significant savings across non-life claims.

Subrogation often fails because the information required for recovery decisions is never captured – not because the analytics are wrong, but because adjusters cannot consistently recognise low-frequency recovery opportunities.

Peopleway® Subrogation provides the behavioural intelligence needed to close this gap by guiding adjusters to notice the right cues, ask the right questions, and record the critical data traditional systems miss.

This creates a more complete subrogation strategy and reliably unlocks 1.0–1.5% in additional savings on non-life claims.

Most organisations try to improve efficiency by reconfiguring systems – but the real bottleneck lies in the human variation inside those systems.

Peopleway® Flow adds a unified behavioural intelligence layer on top of existing platforms, guiding employees through complex workflows, preventing costly errors, and ensuring consistent execution across teams and tools.

This human–system alignment reliably unlocks 10–15% gains in operational efficiency without code, without integration, and without adding pressure to IT.

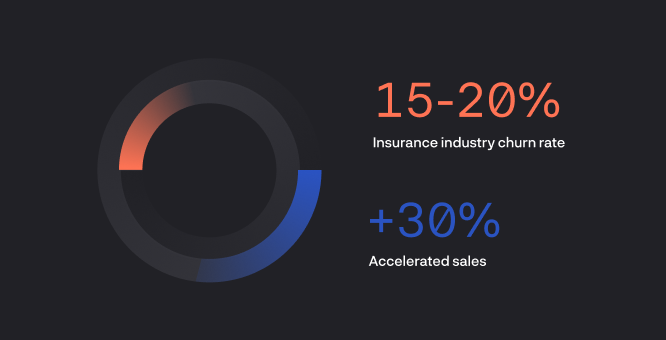

Sales performance varies widely – not because people lack training or tools, but because the behaviours that drive top performance are rarely visible or reinforced.

And in industries such as insurance, where churn rates of 15–20% are common, consistent high-quality sales execution becomes critical for growth.

Peopleway® Sales identifies these high-impact behavioural patterns and strengthens them at scale through intelligent nudging and AI-driven guidance.

The result is more consistent sales execution, higher conversion, stronger retention, and tangible commercial growth.